The Treasury Minister says a bid to make period products exempt from GST is 'a wasted proposition.'

The States Assembly will vote next week on whether to scrap the tax on these items.

But Deputy Susie Pinel says evidence on the impact and effectiveness of doing this 'does not fully consider the Jersey context' - and more needs to be done to understand the potential implications for Jersey consumers, retailers, and the government.

She'll ask States members to agree to exempting or zero-rating period products from GST 'in principle', subject to a review.

"The UK Treasury estimated that removing 5% VAT on period products in 2021 would save the average person nearly £40 over their lifetime. Given that the rate of UK VAT on those products at the time was the same as the current rate of GST, this suggests that the impact for Jersey consumers of removing GST may be limited.

In addition, the full GST reduction (by zero-rating) may not be passed on to Jersey consumers. Some retailers operate GB-wide (sterling-zone retail pricing). Others may be reluctant to pass on low value GST savings to consumers to help offset the increased compliance costs of isolating these zero-rated sales in their accounting and till systems to account for GST correctly.

The experience of the UK suggests that it is not certain that reducing tax passes through to consumer prices: the reduction from 17.5% to 5% VAT on these products in 2001 only saw a 9% consumer price reduction. Whereas the complete removal of VAT on period products in January 2021 coincided with a small (approximately 1%) increase in retail prices between December 2020 and January 2021.

Outside the UK, there is mixed evidence that VAT/GST cuts are reflected in lower consumer prices. Since GST was introduced in 2007, the States Assembly has supported the principle that GST should be low (5%) and broad (limited exemptions and zero-rates) to keep accounting for the tax simple, minimising compliance costs for businesses and keeping administration costs low for Government."

Free period products will be available in all Jersey schools from September and Jersey-registered charities can reclaim GST paid on goods supplied by them.

Deputy Pinel says that type of targeted support 'is more effective than wide-reaching tax cuts that disproportionately benefit those who are better off.'

DFDS brings in replacement ship for Portsmouth sailings

DFDS brings in replacement ship for Portsmouth sailings

100 days until Orkney Island Games begin

100 days until Orkney Island Games begin

£200k padel facility coming to Les Ormes in May

£200k padel facility coming to Les Ormes in May

Two islanders trapped in a lift rescued from sixth-floor fire on the Esplanade

Two islanders trapped in a lift rescued from sixth-floor fire on the Esplanade

Rooftop bar, climbing wall and concert hall in £110m Fort Regent plans

Rooftop bar, climbing wall and concert hall in £110m Fort Regent plans

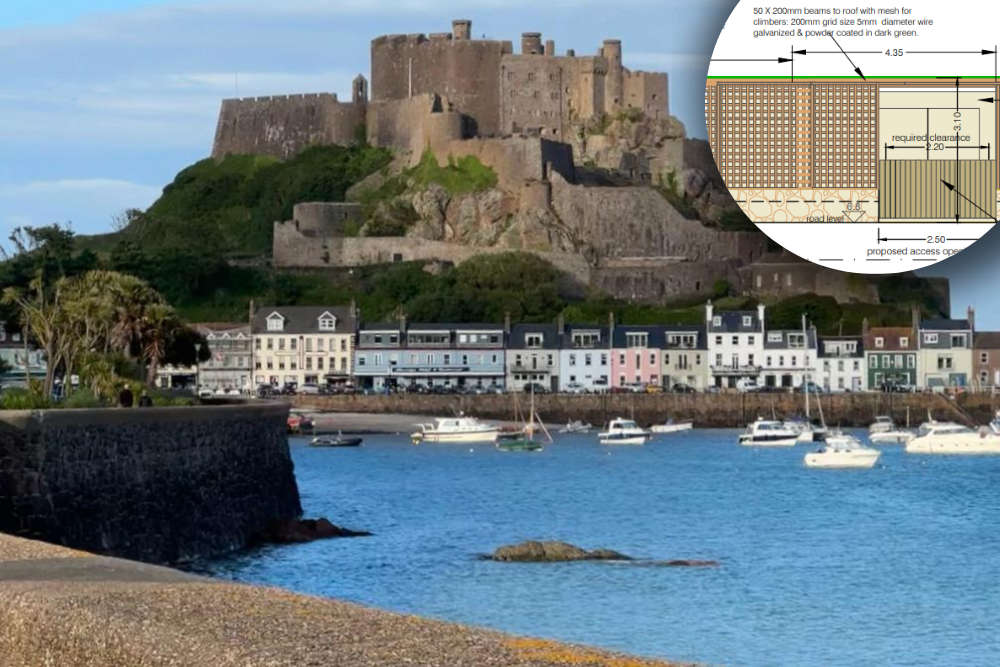

3m tall substation and bin store proposed for Gorey promenade

3m tall substation and bin store proposed for Gorey promenade

European visitors now need permit for UK entry

European visitors now need permit for UK entry

Islanders can catch some winter sun with direct flights from Jersey to Tenerife

Islanders can catch some winter sun with direct flights from Jersey to Tenerife