There is just a week to go before Amazon shoppers in Jersey are charged GST on all their purchases.

For large retailers, the tax will be collected at the point of sale on goods of any value, not when purchases over £60 pounds arrive in the island.

From 1 July the so-called de minimus threshold is being lowered, from £135 to £60.

That means islanders will have to pay GST on anything imported from smaller retailers that is worth more than £60 pounds.

But what few islanders realise is that larger overseas retailers - such as Amazon - have to register with Jersey's government and add GST at the checkout for all purchases, regardless of their value.

Jersey Consumer Council doesn't think many consumers will be aware of the imminent increase in their cost of their online shopping.

Successive recent governments have stated their intention to find ways of 'levelling the playing field' for online and local retailers when it comes to GST.

In January 2021, the then Treasury Minister began looking at ways of collecting GST on all goods imported into the island, regardless of their value.

The de minimus was reduced from £240 to £135 in October 2020. The cut to £60 was due to take effect in January 2023 but was delayed by six months.

The most recent inflation rate in Jersey was unchanged at 12.7%.

The first 'Jersey Contemporary Musician' will be crowned this weekend

The first 'Jersey Contemporary Musician' will be crowned this weekend

Ten rare bats at Jersey Zoo die from infection

Ten rare bats at Jersey Zoo die from infection

Still no date for Rouge Bouillon reopening

Still no date for Rouge Bouillon reopening

New-look Youth Assembly hopes to attract more teens

New-look Youth Assembly hopes to attract more teens

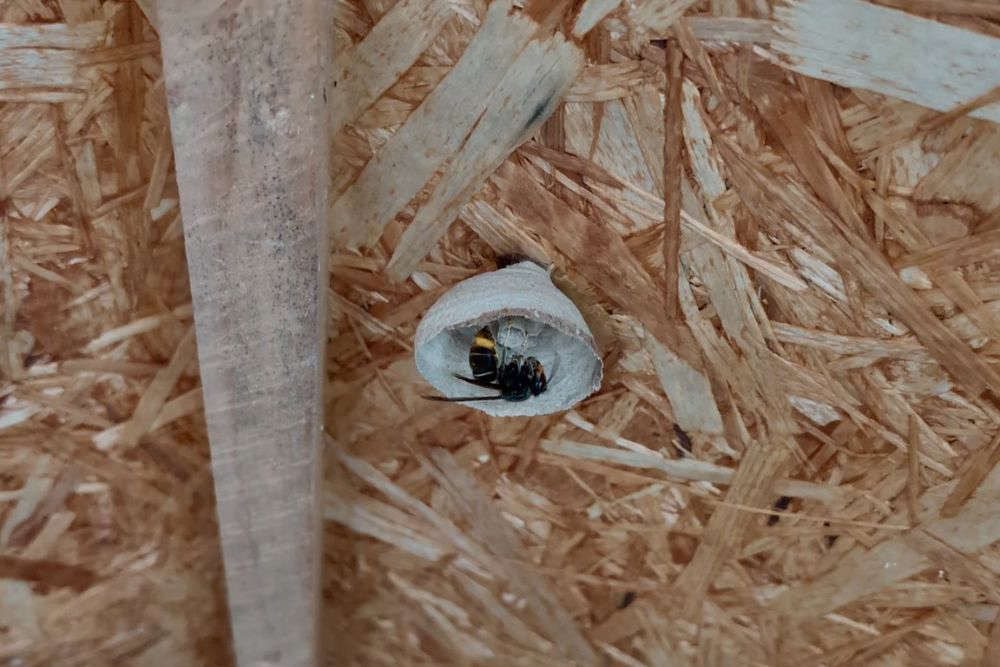

Record year for Asian hornets in Jersey already

Record year for Asian hornets in Jersey already

Man accused of assaulting young girl twice on St Helier's high street

Man accused of assaulting young girl twice on St Helier's high street

Tenant experiences needed to inform changes to renting laws

Tenant experiences needed to inform changes to renting laws

Organ donors to be recognised with public memorial

Organ donors to be recognised with public memorial