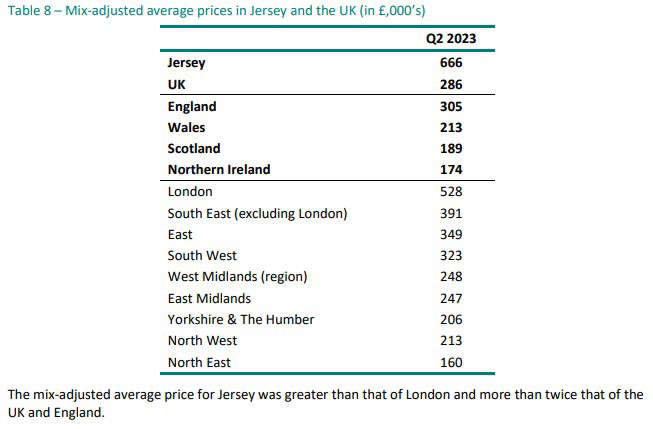

The cost of a one-bed flat in Jersey has jumped by £19,000 compared to the first three months of the year, now costing £356k on average.

The price of a two-bed flat has hit record levels, with an average price tag of £558k, but despite that, it has only seen a slight increase of £2,000 compared to the first three months of the year.

A 3-bed home increased slightly by £6,000 in the same period, to £821,000.

However, a two-bed house's average value dropped significantly, losing £28,000.

Statistics Jersey says that the number of homes changing hands was 42% lower compared to the same time last year.

The Bank of England has increased its base rate of interest 14 consecutive times and now stands at 5.25%, the highest cost of borrowing since the 2008 financial crisis.

Housing Minister Deputy David Warr says we should expect prices to fall because of the 'low level' activity.

"My greatest concern at this time is the low level of activity being seen in the market, which I appreciate will be particularly frustrating for those who are trying to move home, and for those in the property sales industry.

I have been working with fellow Ministers over the summer to develop a workable and sustainable scheme to help Islanders into home ownership, and which I also hope will help stimulate movement in the market."

Over a quarter of homes purchased between April and June were second residencies or buy-to-let, 8% less than the previous quarter.

Mean prices by size in Q2 2023 compared with the previous quarter:

- 1 bedroom flat - £356,000, up £19,000

- 2 bedroom flat - £558,000, up £2,000

- 2 bedroom house - £621,000, down £28,000

- 3 bedroom house - £821,000, up £6,000

- 4 bedroom house - £1,297,000, down £2,000

Jersey athlete, Lily McGarry, appeals for donations for prosthetic limbs

Jersey athlete, Lily McGarry, appeals for donations for prosthetic limbs

Levante Jet makes maiden voyage to Jersey

Levante Jet makes maiden voyage to Jersey

The split between working and non-working Jersey homeless is nearly 50/50

The split between working and non-working Jersey homeless is nearly 50/50

ArtHouse Jersey launches Liberation 80 exhibition

ArtHouse Jersey launches Liberation 80 exhibition

Carers offered free training sessions for dementia

Carers offered free training sessions for dementia

Philip's Footprints introduces new 'Seymour Stroll'

Philip's Footprints introduces new 'Seymour Stroll'

Firefighters save two islanders from serious St Peter car crash

Firefighters save two islanders from serious St Peter car crash

New Channel Islands catamaran tests well in choppy seas

New Channel Islands catamaran tests well in choppy seas