Mortgage lenders and Ministers are being urged to get together and discuss how they can support homeowners in Jersey.

Reform Jersey Deputy Geoff Southern has put forward a proposition asking the Chief Minister to meet with lenders and find ways to ease the pressure on households from rising interest rates.

Deputy Southern wants lenders to allow borrowers to extend their mortgage term or switch to interest-only repayments to reduce their monthly bills.

He also wants repossessions to be banned for 12 months after the first missed payment.

Similar measures were announced by the UK government, labelled the Mortgage Charter.

Deputy Southern thinks Jersey is behind the curve.

"I noticed that the Conservative government in the UK where talking with mortgage lenders and credit providers.

And that's when it became clear to me that our government weren't doing anything like that. There was no mention of help for homeowners - we were just plodding on."

Last week (22 June) the Bank of England made its 13th consecutive increase to the base rate, which now sits at 5%.

That makes borrowing money more expensive and means payments on mortgages, credit cards and loans will be higher.

85% of UK lenders signed the 'Mortgage Charter', Deputy Southern believes there will be a similar uptake here.

"The conditions and the house prices in Jersey are worse than that in London and the South East of England.

I would expect a reasonable conversation between the government and mortgage lenders would produce a similar set of results."

The proposition will be debated in July.

The first 'Jersey Contemporary Musician' will be crowned this weekend

The first 'Jersey Contemporary Musician' will be crowned this weekend

Ten rare bats at Jersey Zoo die from infection

Ten rare bats at Jersey Zoo die from infection

Still no date for Rouge Bouillon reopening

Still no date for Rouge Bouillon reopening

New-look Youth Assembly hopes to attract more teens

New-look Youth Assembly hopes to attract more teens

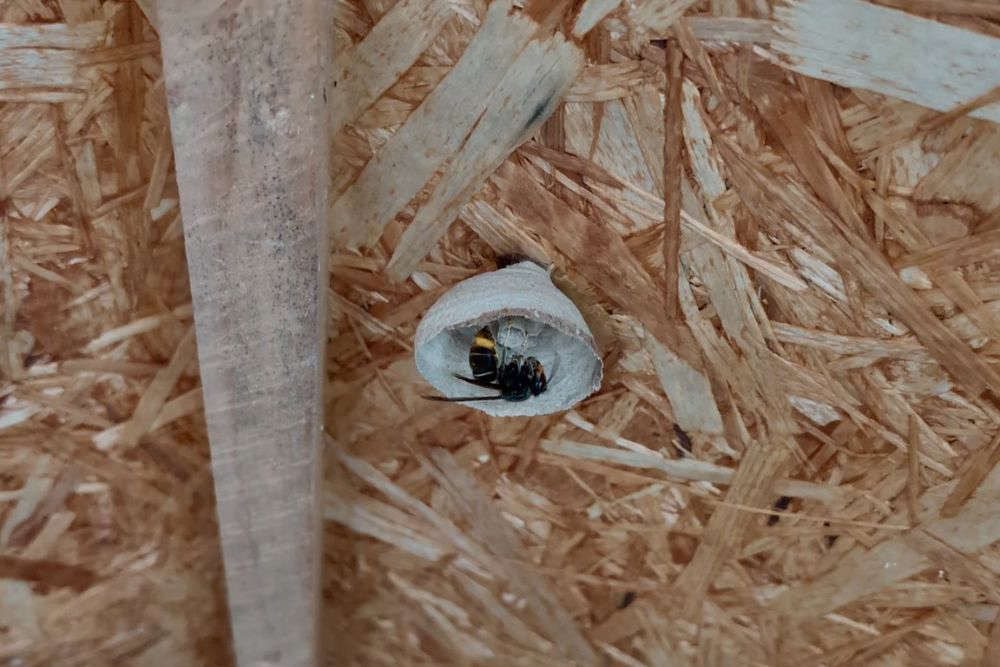

Record year for Asian hornets in Jersey already

Record year for Asian hornets in Jersey already

The colour run returns for Family Nursing and Home Care

The colour run returns for Family Nursing and Home Care

Man accused of assaulting young girl twice on St Helier's high street

Man accused of assaulting young girl twice on St Helier's high street

Tenant experiences needed to inform changes to renting laws

Tenant experiences needed to inform changes to renting laws