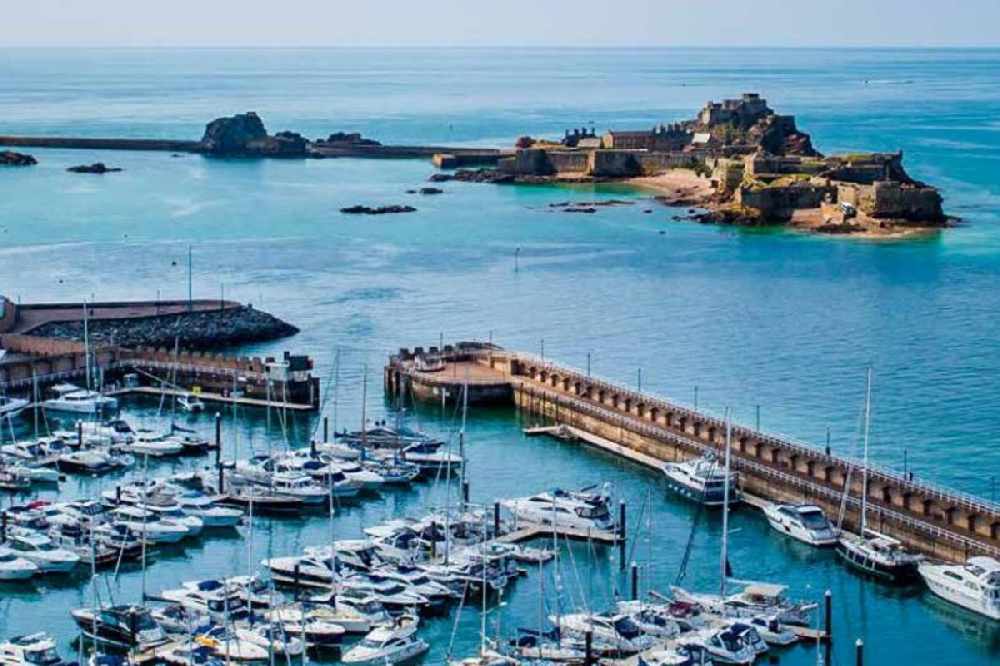

Jersey's government is planning to generate £100 million in savings over the next four years, with spending also going up to nearly £1 billion by 2023.

The Council of Ministers says the savings would come from 'efficiencies', such as reducing duplication, moving services online and replacing out-dated systems.

Chief Minister Senator John Le Fondre says creating more effective public services will help to fund ongoing projects, which will reduce the need to generate more cash from taxpayers.

He explains that raising taxes isn't in the works before those planned savings are tackled.

"We know we are going through a big programme of change, probably the biggest this organisation has faced for a very long time.

"We have identified in the plan some long-term issues we have to address but my personal position is that I don't want to see any major changes to taxation subject to dealing with structural issues that we have to look at until we can demonstrate we've got the efficiencies in place.

£40 million is set to be cut in 2020, with details on where exactly they will be made to come in a plan presented to the Council of Ministers this October.

The Government Plan, described as a long-term approach aimed at benefiting future generations, sets out the programme for spending and generating income between 2020 and 2023.

In contrast to the Medium Term Financial Plan used previously, this government plan can be adjusted on a yearly basis depending on changes and uncertainties such as a No-deal Brexit.

The 2019 Budget was increased to £800 million to meet pressures, with government spending set to increase on a yearly basis to reach £924 million by 2023.

£349 million has been allocated for capital projects, £90.7m of that in 2020 - which will include:

- £5 million on health care improvements

- £3.9 million on improvements to mental health facilities

- £2 million on improving school facilities

- £1.7 million on prison improvement works. The plan is to increase police officer numbers to 215 by 2020.

- £2 million on finding a solution for Fort Regent

- £2.3 million on IT for the Combined Emergency Services Control Room

- £5 million to continue work on the new hospital project

- £6.1 million on cyber security

- £7.4 million on an integrated back-office IT system

- £16 million on replacing and refurbishing existing assets

- £9.4 million to continue work on new sewage treatment and extensions

The plan centres around the six priorities set out by the Council of Ministers last year:

Putting children first - £94.4M over the four years, £20.7m in 2020. Work on improving standards in nurseries and schools, better child and adolescent services and a sustainable funding settlement for each element of the education system - including early years, schools and post-16 education.

Improving islanders' well-being and mental and physical health - £99.9M over the four years, £12.7M in 2020. Work on a new model of healthcare, improved access to primary care and expanding the 24-hour community nursing and primary care services.

Creating a sustainable and vibrant economy - £80.3M over the four years, £14.9M in 2020. Work on a new Migration policy, a new post-16 education strategy and dedicated 1% of the budget to arts and culture.

Reducing income inequality and improving the standard of living - £22.7M over the four years, £3.9M in 2020. Work on improving support for tenants, changes to contributory benefits to help both parents and more support to get workers with long-term health conditions into work.

Protecting and valuing the Environment - £15.2M over the four years, £3.1M in 2020. Work on creating a new Climate Emergency Fund, with £5m set aside next year. New schemes to encourage more sustainable transport and improving countryside access.

Modernising government - £141.4M over the four years, £25.4M in 2020. Work on improving the electoral system, more investment in public-sector employees and increasing police officer numbers.

Plans to balance the budgets have also been included as part of the plan:

- Long-term care contributions will rise from 1% to 2% in 2020, with the income cap also increasing from £176,232 to £250,000. The government says that will prevent further increases for the next 25 years.

- Employer and Class 2 Social Security contributions will rise from 2% to 2.5% for earnings of more than £53,000., up to a new income cap of £250,000.

- Income-tax thresholds will increase for a single person to £15,900 and for a married couple to £25,500.

- The second-earners allowance will go up by £250, which the government says will maintain parity between married and cohabiting couples.

Alcohol, tobacco and road fuel duty will increase to generate around £6 million in 2020, while the GST 'de minimus' value of goods will reduce from £240 to £135.

"The government is committed to balancing the budget, after making transfers to the Stabilisation Fund, and to keeping taxes low and broad. While we are increasing spending in the Government Plan, our prudent planning, backed by sustainable efficiencies, keeps our forecast spend after efficiencies below what was originally forecast in Budget 2019.

"We are ensuring what we do can be paid for, without placing undue burdens on islanders. We are taking the important decisions now to tackle the future needs of our Island, creating a positive long-term legacy for Islanders." - Senator John Le Fondre, Chief Minister.

The plan will be debated in the States Assembly this October.

WATCH: Last Blue Islands plane leaves Jersey

WATCH: Last Blue Islands plane leaves Jersey

Jersey pupils secure places in STEM Racing UK National Finals

Jersey pupils secure places in STEM Racing UK National Finals

Plémont puffins get a Christmas makeover

Plémont puffins get a Christmas makeover

New café bar and kitchen coming to Jersey Airport

New café bar and kitchen coming to Jersey Airport

Fresh process to choose Havre des Pas Lido operator

Fresh process to choose Havre des Pas Lido operator

Jersey Water has 100% compliance in all water quality standards, including PFAS

Jersey Water has 100% compliance in all water quality standards, including PFAS

Large-scale Jersey drug dealer jailed

Large-scale Jersey drug dealer jailed

Jersey's politicians agree 2026 Budget

Jersey's politicians agree 2026 Budget

Comments

Add a comment