Islanders will be paying GST on lower-value imported goods from October.

The value of items the 5% tax will be applied to will drop from £240 to £135.

The de minimus level was due to be lowered in July and then was postponed until next January.

But the Treasury Minister says, now the economy is reopening, it should be brought forward to help local businesses compete with off-island retailers.

It means if you order a product costing more than £135 to be delivered to the island, Customs will hold on to it until officers recover the tax due.

Deputy Susie Pinel has also said plans to charge interest on new tax debts have been deferred until the 1st of January 2022 at the earliest.

Currently taxpayers are charged a fee if they underpay their taxes and don't pay the full amount by the 30th of November each year.

“I originally deferred the reduction of the de minimis level from 1 July 2020 to 1 January 2021 to support Islanders who would be reliant on home deliveries during lockdown. As we are opening up the local economy, bringing down the “de minimis” level will enable on-Island business to compete more fairly with off-Island retailers, supporting our local economy.

I have also decided to defer charging interest on tax debts in recognition that many businesses and individuals will suffer financially due to the pandemic at least in the short term.”

The Chamber of Commerce has welcomed the de minimus announcement, saying it will help local retailers recover from the Covid-19 crisis.

The colour run returns for Family Nursing and Home Care

The colour run returns for Family Nursing and Home Care

The first 'Jersey Contemporary Musician' will be crowned this weekend

The first 'Jersey Contemporary Musician' will be crowned this weekend

Ten rare bats at Jersey Zoo die from infection

Ten rare bats at Jersey Zoo die from infection

Still no date for Rouge Bouillon reopening

Still no date for Rouge Bouillon reopening

New-look Youth Assembly hopes to attract more teens

New-look Youth Assembly hopes to attract more teens

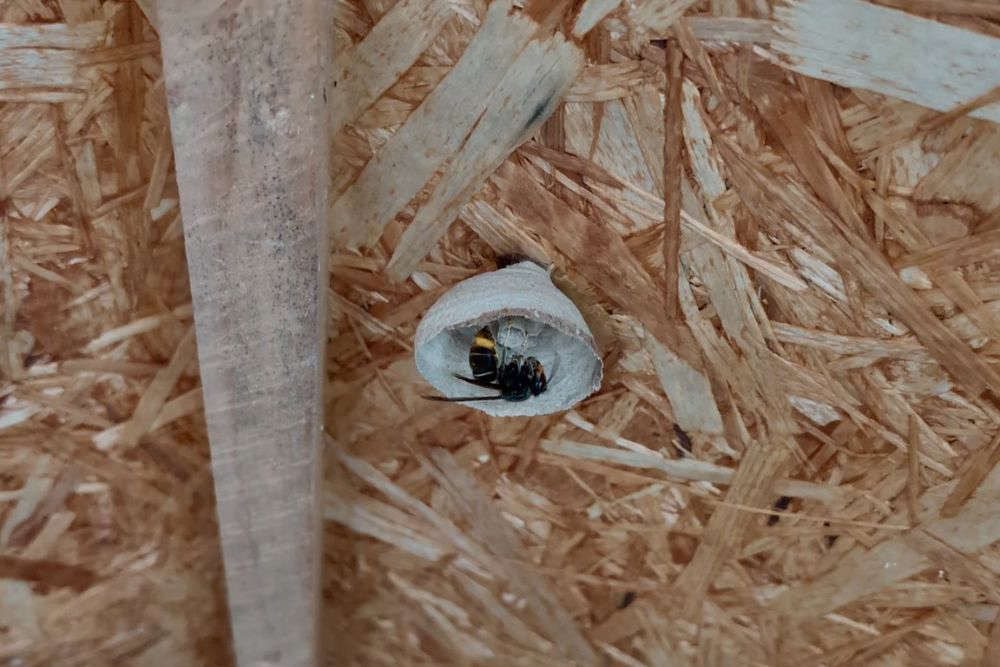

Record year for Asian hornets in Jersey already

Record year for Asian hornets in Jersey already

Man accused of assaulting young girl twice on St Helier's high street

Man accused of assaulting young girl twice on St Helier's high street

Tenant experiences needed to inform changes to renting laws

Tenant experiences needed to inform changes to renting laws