Wide-ranging suggestions on how Guernsey could cut the cost of public services have been collated.

The savings sub-committee has said that Guernsey needs recurring cost reductions of between £10m and £16m per annum, within five years, to recover from a financial deficit - and decided a public survey would be another way of looking at the problem.

Over the course of three weeks, 637 individuals submitted 1,416 suggestions.

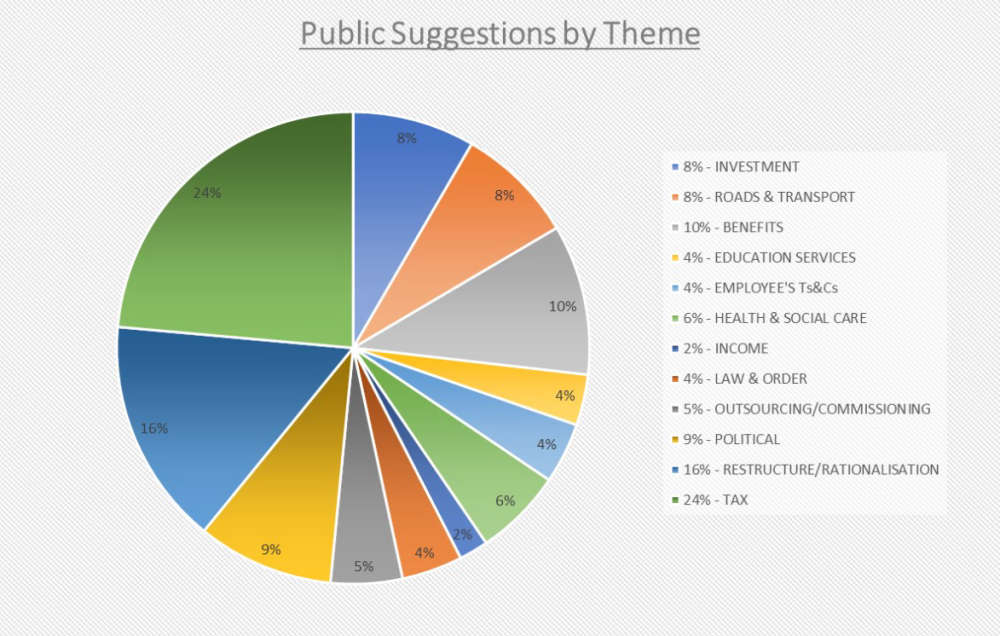

The public were allowed to submit three ideas. The committee found some of these were multi-faceted and decided to split them up - leaving 1,756 ideas to categorised:

Out of the 12 categories, Tax-related suggestions were the most frequent.

Almost a quarter of respondents (24%) mentioned: income tax, consumption taxes, property taxes, corporation taxes, and other duties.

The public suggested raising, lowering, restructuring, changing collection, or introducing new taxes.

The sub-committee says although tax was not the focus of the survey this information will be passed onto the Policy & Resources Committee.

The second most popular suggestion, taking up 16% of the pie chart, was ‘Restructure/Rationalisation'.

This relates to the size and structure of the public sector and the State’s property portfolio.

It also questions the use of using external experts in consultations, The relationship with States trading assets, adjusting benefit rates and States Members’ pay were also popular ideas.

A second survey was sent to public sector employees during the same three-week period.

The sub-committee thought it would be useful to compare this, as the staff has 'intimate knowledge' of the services.

196 individuals responded to this survey, with 394 suggestions split into 447 ideas.

These have been split into the same twelve categories and have some similarities.

The two most popular categories switched places, with Restructure/Rationalisation getting 26% and Tax 17%.

These results will now be reviewed by the Sub-Committee before the final recommendations are presented to the States Assembly in 2024.

Four Guernsey residents on the New Year Honours List

Four Guernsey residents on the New Year Honours List

Patrols at La Valette bathing pools after recurring antisocial behavior

Patrols at La Valette bathing pools after recurring antisocial behavior

Enhanced protection for Sark's sea life

Enhanced protection for Sark's sea life

Skeleton of new Guernsey golf resort built

Skeleton of new Guernsey golf resort built

Prominent Guernsey man appointed Commissioner for Standards

Prominent Guernsey man appointed Commissioner for Standards

Record festive parcel delivery for Guernsey Post

Record festive parcel delivery for Guernsey Post

Channel Islands Ferry Operators Working Group expands

Channel Islands Ferry Operators Working Group expands

Sculpture to remember the Alderney evacuees

Sculpture to remember the Alderney evacuees