A Guernsey travel agent says in practice, anyone who's booked a trip recently should still be covered, but Citizens Advice says it may be best to get travel insurance.

ATOL is run by the Civil Aviation Authority and covers a holidaymaker if their travel company goes bust while they're away.

It means anyone whose package holiday is ATOL protected and a certificate issued, could get back home using the scheme.

Last month, trade publication Travel Gossip reported that ABTA (the Association of British Travel Agents) had written to its members saying it had received clarification that its ATOL protection scheme only covers residents of the UK.

It appears that the CAA ceased providing ATOL cover to people in the Crown Dependencies when Brexit kicked in. But Guernsey travel agent Jamie Blondel, who's looked into the issue, says anyone whose holiday is already booked, shouldn't worry:

"They’ve now (the CAA) said they’ll cover any ATOL certificate that’s been issued. In other words, any package holiday that’s been booked, and an ATOL certificate has been issued or paid for, they will honor and will continue to do so for the time being."

However, Jamie says there's uncertainty over how long the CAA will continue with what now appears to be a 'gentleman's agreement'.

"At the moment we don’t know how long that will be, weeks, months or years. Obviously, they need to give a period of grace or notice if they are going to stop it."

"I've spoken to other agents in Jersey and the Isle of Man about this and none of us were told about it. They haven't given us any timescale at all."

We have contacted the CAA for clarification but they have not responded.

It's this general uncertainty that has prompted Ali Marquis from Citizens Advice in Guernsey to suggest that islanders get their own insurance:

"We'd advise anyone who's going on a package holiday, or is in the process of booking one, to have a look at their policies or take out separate cancellation insurance to ensure that they are covered for this eventuality."

ATOL cover isn't the only benefit to be gradually withdrawn from the Crown Dependencies. Many people with a credit card from certain providers have been told they'll no longer be able to use it. It follows difficulty in assessing credit ratings, given that islanders aren't on the UK electoral roll.

In October 2023, Jersey passed a new law to share more information with the companies that do credit card checks in the hope it would resolve the problems.

68% of Guernsey post boxes set for removal

68% of Guernsey post boxes set for removal

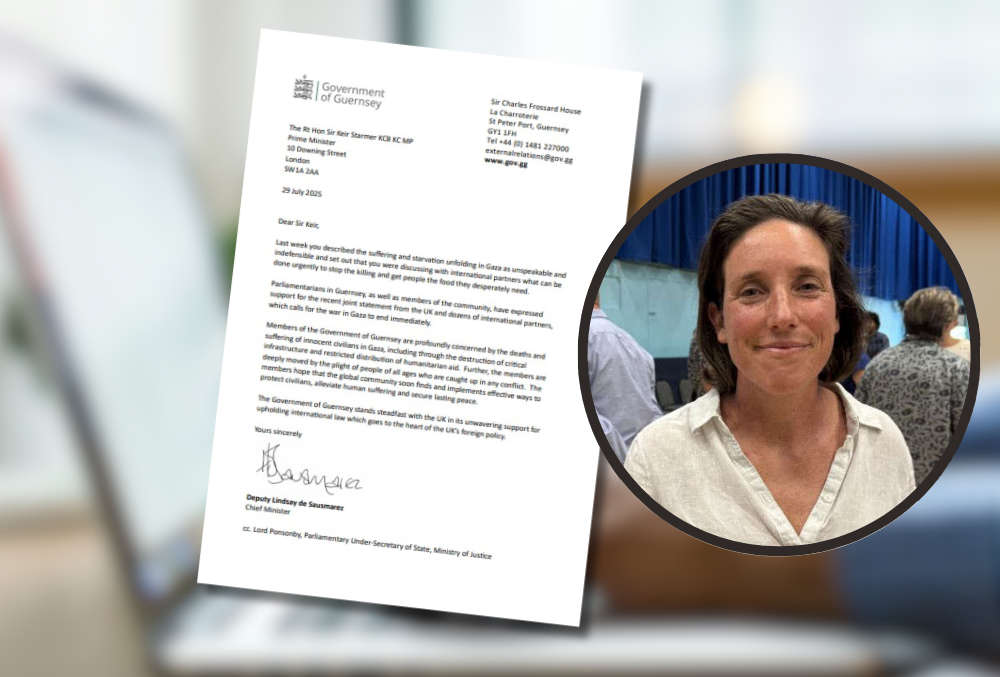

Guernsey joins calls for peace in Gaza

Guernsey joins calls for peace in Gaza

Guernsey's population may be 3% smaller than stated

Guernsey's population may be 3% smaller than stated

Cimandis to pull food wholesale operation from the Channel Islands

Cimandis to pull food wholesale operation from the Channel Islands

New External Relations Lead selected amid Guernsey Police investigation

New External Relations Lead selected amid Guernsey Police investigation

Vale Douzaine to host two emergency sleeper pods for Guernsey homeless

Vale Douzaine to host two emergency sleeper pods for Guernsey homeless

Guernsey deputies express dismay over famine in Gaza

Guernsey deputies express dismay over famine in Gaza

Guernsey education experts help shape new National Writing Framework

Guernsey education experts help shape new National Writing Framework