Deputy Peter Roffey says he is 'shocked' to see means-testing Guernsey's state pension are part of P&R's latest proposals.

Means-testing islanders for the state pension would be a 'breach of a promise', according to Deputy Peter Roffey.

He has described the suggestion from Policy & Resources as 'complete madness'.

1. Quite a shock to see that in the 48 hours between asking ESS to comment on the tax policy letter and publishing it P+R has amended it to introduce the concept of means testing the basic, contributory, states pension. Yet to discuss with my committee but I think this is ....

— Peter John "Rufus" Roffey (@PeterRoffey5) August 23, 2021

3. Can't then deny those who contributed most any benefit at all. Makes it pure tax. Effectively 29% income tax. If GST is unpopular this will trump it. Think a supplementary letter of comment may be needed.

— Peter John "Rufus" Roffey (@PeterRoffey5) August 23, 2021

The Employment & Social Security President says his department has been part of the discussion team planning revenue raising ideas. But, he has described this late addition as 'complete madness'.

"It came as a real shock to see that in the interim the policy letter had been changed to really big up this idea of means-testing contributory benefits - of which, by far, the biggest is the old age pension.

Means-testing for things paid out of taxation is perfectly understandable - that's how tax works. But...when it comes to contributory benefits, like the pension, (it) is a social contract.

We tell people to pay in their contribution for decade after decade, and for them to say 'you might not get anything for it in return whatsoever because we don't think you need it', is beside the point. They have paid for it, and they are entitled to it."

Deputy Roffey says labelling it as 'contributions' is misleading.

"If you paid in all of your contributions that are required, which requires several decades to do; to say that some people might get nothing out of it at the end of the day I think is just outrageous.

It's just turning it into a tax. If they (P&R) want to turn it into a tax, they may as well be honest and just increase taxation rather than increasing contributions into a scheme for which you don't get what you're contributing for.

My committee now are going to have to meet to discuss that because I think that that really does cross a complete red line for us."

Introducing GST - a goods and services tax of up to 8% - is among other suggestions for raising revenue to help meet the pressures of paying for an ageing population.

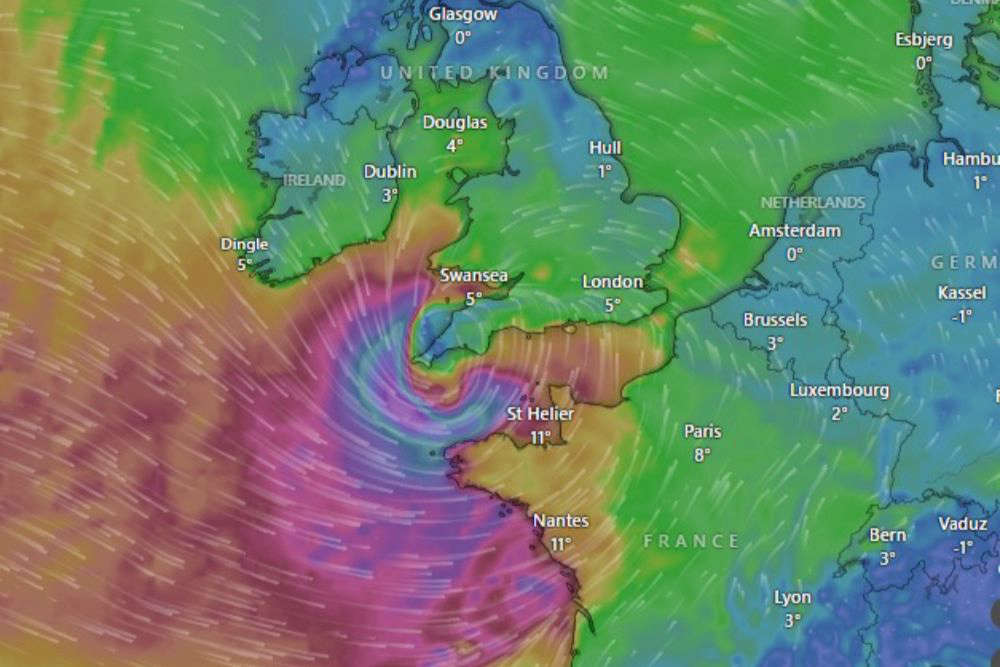

Storm Goretti prompts stay-at-home warning in the Channel Islands

Storm Goretti prompts stay-at-home warning in the Channel Islands

The Dean of Guernsey to retire later this summer

The Dean of Guernsey to retire later this summer

Yacht escorted into St Peter Port after radio contact is lost

Yacht escorted into St Peter Port after radio contact is lost

Guernsey's animal shelter prepares for injured wildlife from Storm Goretti

Guernsey's animal shelter prepares for injured wildlife from Storm Goretti

Guernsey hospice struggles with running costs

Guernsey hospice struggles with running costs

Body piercing age limit in Guernsey could be lowered to 16

Body piercing age limit in Guernsey could be lowered to 16

Nighttime cliff rescue in Guernsey

Nighttime cliff rescue in Guernsey

New Year diversions for Guernsey commuters

New Year diversions for Guernsey commuters