Deputy Heidi Soulsby says the effect of GST on the index-linked States pension fund hasn't been factored into P&R's calculations.

Deputy Heidi Soulsby has analysed P&R's figures and says the first year of introducing GST - if approved - will cost in excess of £90M.

That's £50M more than P&R's estimate, because of the effect of the tax on the States pension fund, which is index linked:

"If there is any change in the underlying rate of inflation and inflationary effect, which we know GST will have, that will impact on the pension scheme. It'll basically take a chunk out of that fund and, whether it's under or over invested, it's effectively impacting the taxpayer."

"It'll be a one-off deterioration in the funding level of around £50M. That's a big chunk. It'll take the whole cost of GST for the first year to £90M."

Deputy Soulsby is allied with deputies Gavin St PIer and Sasha Kazentseva-Miller over their approach to public finances. They call themselves the Fairer Alternative and intend to put forward their own plans ahead of next week's debate:

"I suppose you could call it scenario four, after their three. It puts together a balanced package which we think is pragmatic and realistic, particularly at this time in the States term."

Deputies will debate GST for a second time next week, beginning a day earlier than normal on Tuesday 17 October.

P&R's first attempt to bring it in was defeated in February.

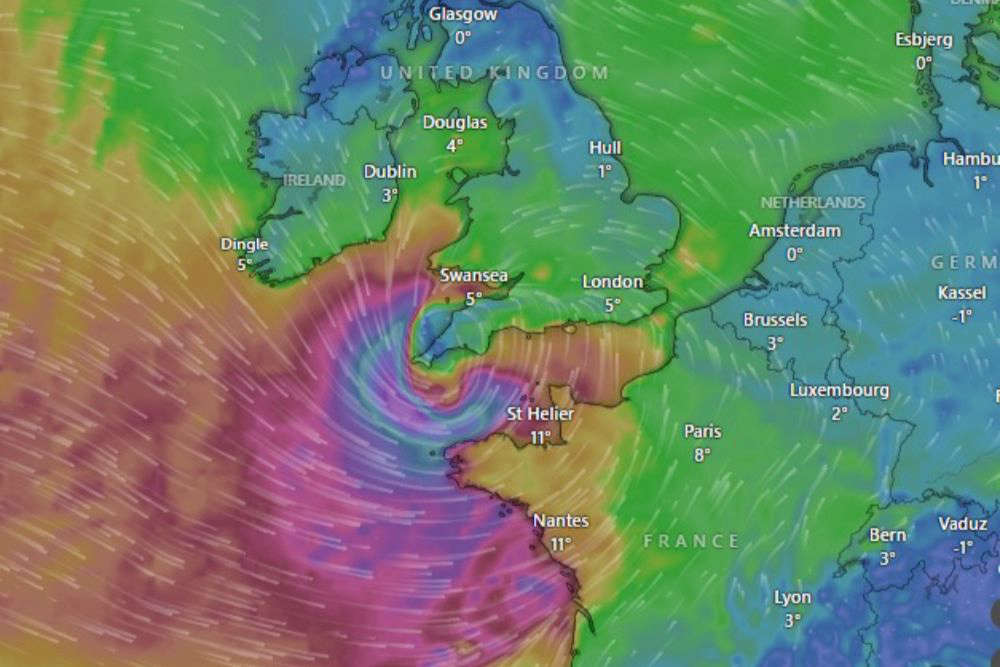

Storm Goretti prompts stay-at-home warning in the Channel Islands

Storm Goretti prompts stay-at-home warning in the Channel Islands

The Dean of Guernsey to retire later this summer

The Dean of Guernsey to retire later this summer

Yacht escorted into St Peter Port after radio contact is lost

Yacht escorted into St Peter Port after radio contact is lost

Guernsey's animal shelter prepares for injured wildlife from Storm Goretti

Guernsey's animal shelter prepares for injured wildlife from Storm Goretti

Guernsey hospice struggles with running costs

Guernsey hospice struggles with running costs

Body piercing age limit in Guernsey could be lowered to 16

Body piercing age limit in Guernsey could be lowered to 16

Nighttime cliff rescue in Guernsey

Nighttime cliff rescue in Guernsey

New Year diversions for Guernsey commuters

New Year diversions for Guernsey commuters